In April, China aluminum production declined to 3.3Mt, with a decrease of 3% m/m and 1% y/y, due to the sudden shut down in southwest regions in March.

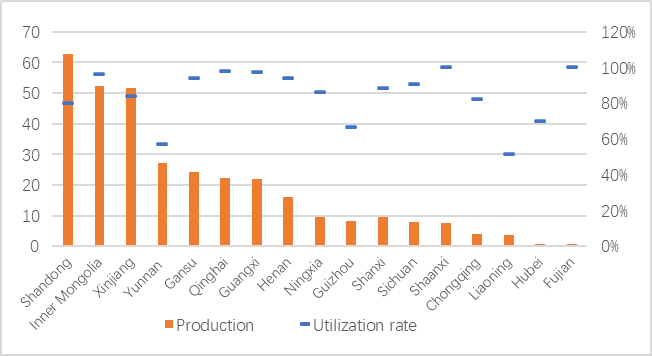

Exhibit1: China aluminium output by province in April

The continuous resume and launch in Guangxi, Guizhou and Inner Mongolia successfully offset the sudden withdraw of smelters in Yunnan. According to the number of utilization rate by province, most of smelters already hit historical high position, except once in Yunnan and Guizhou. In April, the utilization rate of smelters in Yunnan was mere 57%, the idle capacity including the transferred capacities from another province, new projects, and resumption in plan.

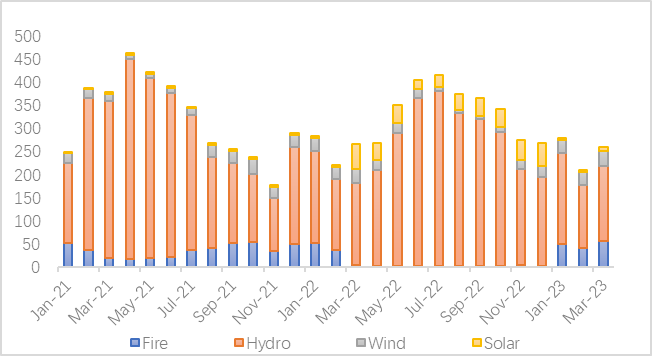

Exhibit 2: power generation in Yunnan province.

Through the past month, aluminium price still fluctuated at RMB18,500/t. Marketers are worried about future demand in light of worse money liquidity but high inflation in main economic region. However, as we saw, China car market, or even the whole manufacturing industry still performed strong growth so far. The utilization rate of smelters in Yunnan province the fourth largest area of China to produce aluminium attracted much attention.

Will Yunnan generate sufficient power to meet residents’ and industries’ need?

In 2022, power generation sourcing from wind and solar had a sharp increase, while the same time, the utilization rate of fire power almost close to zero since March in 2022.

The unexpected drought deeply impacted the contribution of hydropower, in final it declined by 15 y/y. So far this year, power supply from fire stations resumed sharply, 64% higher y/y. In addition, the installed capacity of fire generation in Yunnan increased by 4% y/y, adding the year-on-year growth of 15% and 6% on wind and solar, the number of total installed capacity of power generation in Yunnan hit 1.14 trillion kilowatt-hours. However, hydropower generation in Q1 2023 was still less 7% y/y due to the unimproved drought. The rainfall in Yunnan is much less than expected.

In March, the power consumption for secondary industry in Yunnan were mere 13 billion kilowatt-hours, at the lowest position in 2022, but higher than the average in 2021, because of the influx of hug number of smelters. In 2022, hydropower consumption in peak season hit 17 billion Kwh. However, based on current weather situation, it is unlikely that hydropower generation would run at full speed to meet the demand. We expect China aluminium output in Q2 could be at the range of 3.3-3.4Mt per month.

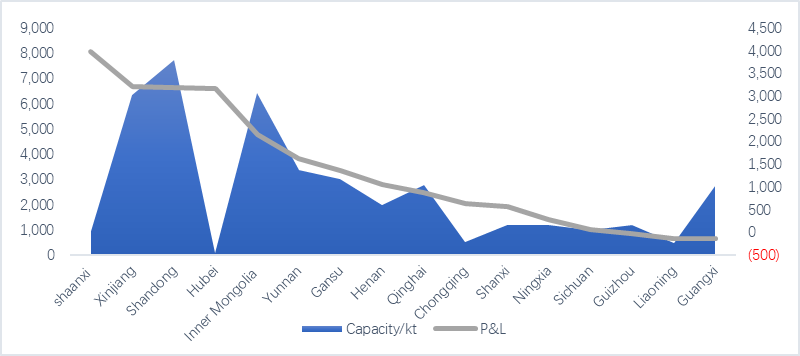

Exhibit 3: China aluminium capacities in profit or loss by province.

From the perspective of cost, the benchmark price of China aluminium fluctuated at RMB18,500/t.

However, prices of all materials had gone back to low position. Thanks for the withdraw, the profits of smelters rocked over RMB3,000/t, only 11% of the operation were in a loss, which distributing around in southwest regions, such as Sichuan, Guizhou and Guangxi. Because the power price in dry season is much higher than others. But it’s expected to reduce in coming rainy season.

Without sudden restrictions such as power shortage or policy intervention, China aluminum output would continue to increase, to meet the potential demand and to chase the rich profits.

您好,这是一条评论。若需要审核、编辑或删除评论,请访问仪表盘的评论界面。评论者头像来自 Gravatar。