This is the week filled with sanctions.

“The U.S. Treasury Department and the British government on Friday banned the 147-year old LME and the Chicago Mercantile Exchange (CME) from accepting new Russian production of aluminum, copper and nickel produced from April 13.”

“After a careful review of the current situation in Venezuela, the United States determined Nicolas Maduro and his representatives have not fully met the commitments made under the electoral roadmap agreement, which was signed by Maduro representatives and the opposition in Barbados in October 2023. Therefore, General License 44, which authorizes transactions related to oil or gas sector operations in Venezuela, will expire at 12:01 AM on April 18…. the United States will issue a 45-day wind-down license. ”

Discussion about the potential impact of the restriction on Russian aluminium hadn’t subsided,

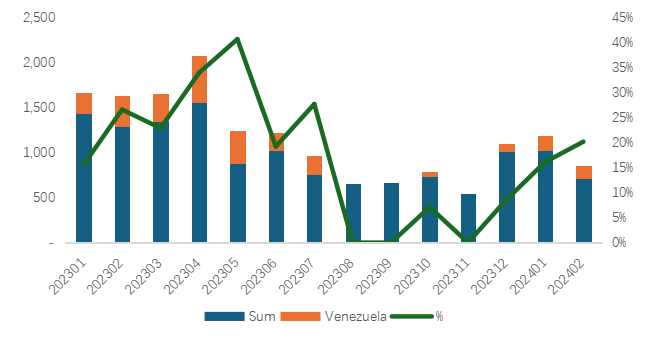

sanctions on Venezuela brought new problems to test current fragile global supply chain. Regarding the supply of crude oil, the contribution from Venezuela to China is relative tiny. However, volumes of imported high sulphur green coke from Venezuela surged over 2.3Mt in 2023, accounting for 19% of the whole market. NTC clearly pointed out in our special report at the beginning of the year that marketers have to pay close attention to emerging US-Venezuela tensions.

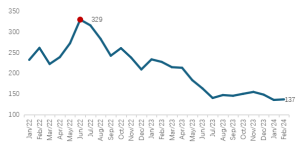

At the start of reopen in 2023, general view is that the future demand for coke is considerable based on optimistic forecasts for emerging new energy market. However, global markets have been less resilient than expected.

The average price touched $137/t in February this year, back to the same point in May of 2021.

Venezuela high sulphur coke is mainly supply to cement factory and power plants, rarely used to produce anode or synthetic graphite. If Venezuela coke disappeared from the market, 20% share is likely refilled by other two major suppliers, USA, and Russia. But Venezuela’s attitude towards the sanction seems like that they will not accept it. We have to pay close attention about it.

Apart from these, what’ll happen about Iran oil and China Aluminium products export?