China passage car output fell by 9% m/m, and the proportion of aluminium consumption in passage car returned to 10%.

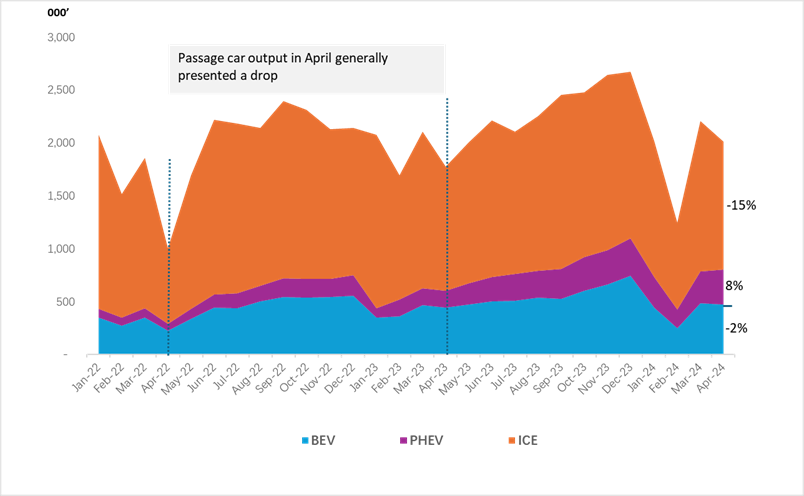

In April, the number of passenger car production in China were mere 2,010 thousand units, almost as low as January this year. Among them, BEV unexpectedly declined by 2% m/m, and PHEV showed an expected growth of 8% m/m, relatively, the rest mainly referring to ICE (internal combustion engine) dropped by 15% m/m in April.

From January to April, total production of passenger car declined by 2% y/y. the contribution of ICE declined by 13% y/y, while the output of Evs rose by 26%, it’ s worth noting that the growth of BEV in the past four years was 2% y/y, at the meantime, PHEV output rose by 96% y/y, we’ve pointed out last month that the output structure of new energy vehicles is changing.

There seems to be a voice in the market that is beginning to worry about the sales momentum of China’s electric vehicles. However, judging from the development trend of passenger car production in previous years, automobile production in April will decline slightly. After the major promotions before the Spring Festival ended, the market began the off-season sales period from February to April. Therefore, the decline in output is normal.

Sales in the first half of the year will be concentrated before the end of June, that is, in May and June. In less than a month in the past, the government has introduced supporting policies to encourage the development of the new energy industry. By encouraging trade-ins in the form of subsidies, and allowing companies to formulate car purchase subsidy plans, coupled with the previous policy of zero down payment for car purchases. At the beginning of the month, the market’s buying sentiment was still mainly wait-and-see. However, with the implementation of various incentive policies, the consumption volume in the market is expected to rise rapidly in the future.

At the same time, such high-intensity incentive policies have hurt ICE industry and there is basically no room for price reduction. The number of PHEV has increased significantly, and low-priced products have eroded market share of ICE.

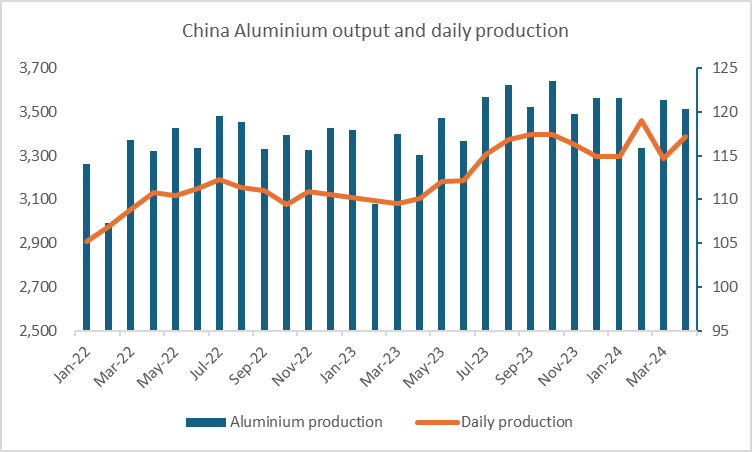

In addition, changes in the proportion of automobile output have also brought about changes in the consumption of aluminum products. In April, with the successive resumption of aluminum smelters in Yunnan, daily output increased by 2% m/m. However, due to a slightly shorter operating period, the output in April was slightly lower than the previous month.

At the same time, due to the sharp decline in the production of ICE and the flat supply of BEV, the proportion of aluminum consumption in passenger cars has returned to 10%, but this number is expected to rise to 11% next month.

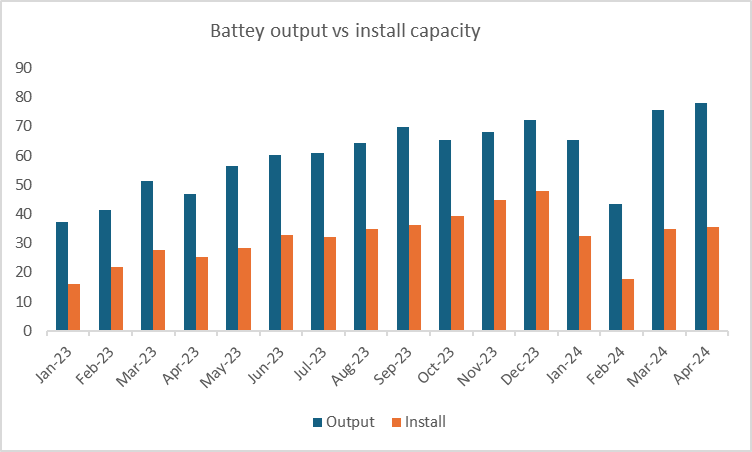

China power battery including storage production in April rose to 78.2Gwh, up by 3% m/m. while, the installed battery in April were mere 35.4Gwh.

The contribution of storage and exports continued to increase in April. Sales of LFP battery used for EVs is33.5Gwh, declined by 14% m/m. Sales of LFP battery used for storage rose to 18.4Gwh, up by 69% m/m. This figure exactly corresponded to production of passenger car.

In addition, we still need to emphasize the issue of Evs output structure. Up to now, PHEV still dominated by its increment, but its battery capacity requirements are not high, in other words, the stimulus for battery demand remains limited. In April, the average capacity per Ev declined to 47.1Kwh.

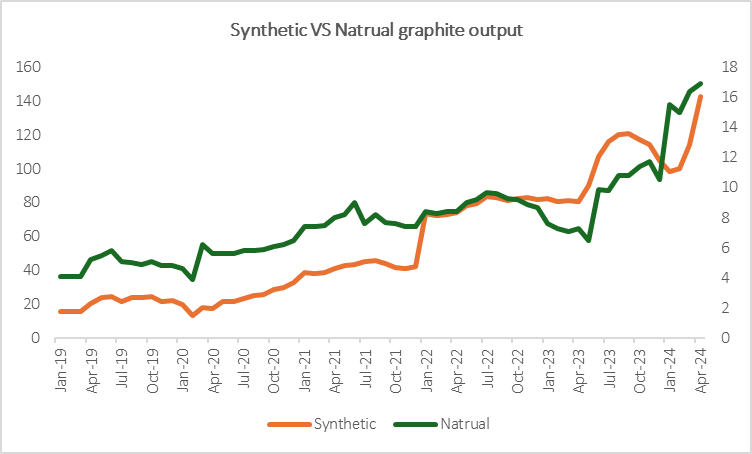

Form the perspective of anode materials output (synthetic graphite), production in April hit record high, even excessed the output in December last year, at when BEV and PHEV both same marked a historical high production.

Considering that it takes longer for battery cell to be put on the market, this increase is reasonable in order to be fully prepared for the upcoming peak season and to replenish current product inventory. But at this point, it is difficult for BEV to break through last year’s high again.

The current development environment of the new energy industry is that bulk products continue to rise, but the price of end-user goods continues to decline. Therefore, manufacturing companies in the middle stages, especially those where the industry’s designed capacity has clearly exceeded demand, continue to be on the verge of almost losing money. More orders are gathered at leading companies, but margins are very low.