Review’ The Commission has pre-disclosed the level of provisional countervailing duties it would impose on imports of battery electric vehicles (‘BEVs’) from China. Should discussions with Chinese authorities not lead to an effective solution, these provisional countervailing duties would be introduced from 4 July by a guarantee (in the form to be decided by customs in each Member State). They would be collected only if and when definitive duties are imposed.

The individual duties the Commission would apply to the three sampled Chinese producers would be: BYD: 17,4%; Geely: 20%; and SAIC: 38,1%.

Other BEV producers in China, which cooperated in the investigation but have not been sampled, would be subject to the following weighted average duty: 21%.

All other BEV producers in China which did not cooperate in the investigation would be subject to the following residual duty: 38,1%.

Following a substantiated request, one BEV producer in China – Tesla – may receive an individually calculated duty rate at the definitive stage. ‘

Regarding the survey results, it should be noted that this announcement only targets BEV, not plug-in hybrids and other types. And the subjects of the survey are BEV from China. This is crucial to the impact of this incident.

This article only studies and analyzes the impact that the conclusion may cause.

Demand for BEV from China in the European market:

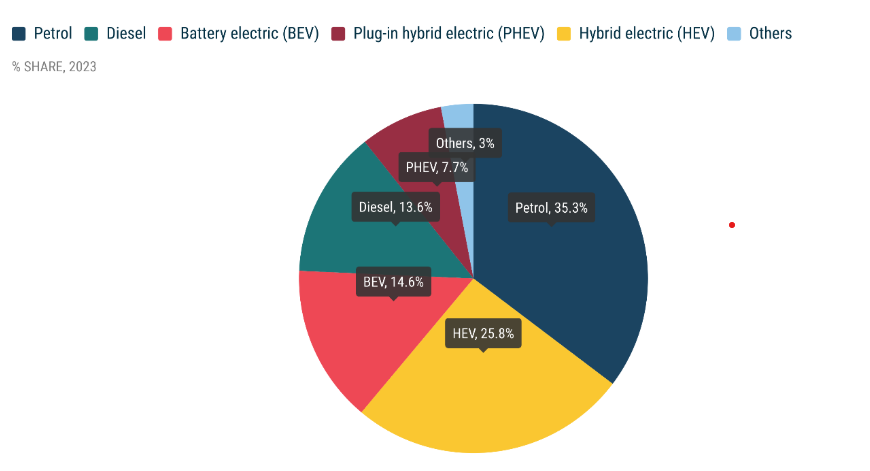

According to data released by ACEA, in 2023, the EU car market concluded with a solid 13.9% expansion compared to 2022, reaching a full-year volume of 10.5 million units. Battery-electric cars market share surged to 14.6% in final, about 1.53 million units.

It can be seen that the penetration rate of new energy vehicles in the EU is not high, although the proportion of ICE is shrinking year by year. In China, the share already broke 50%.

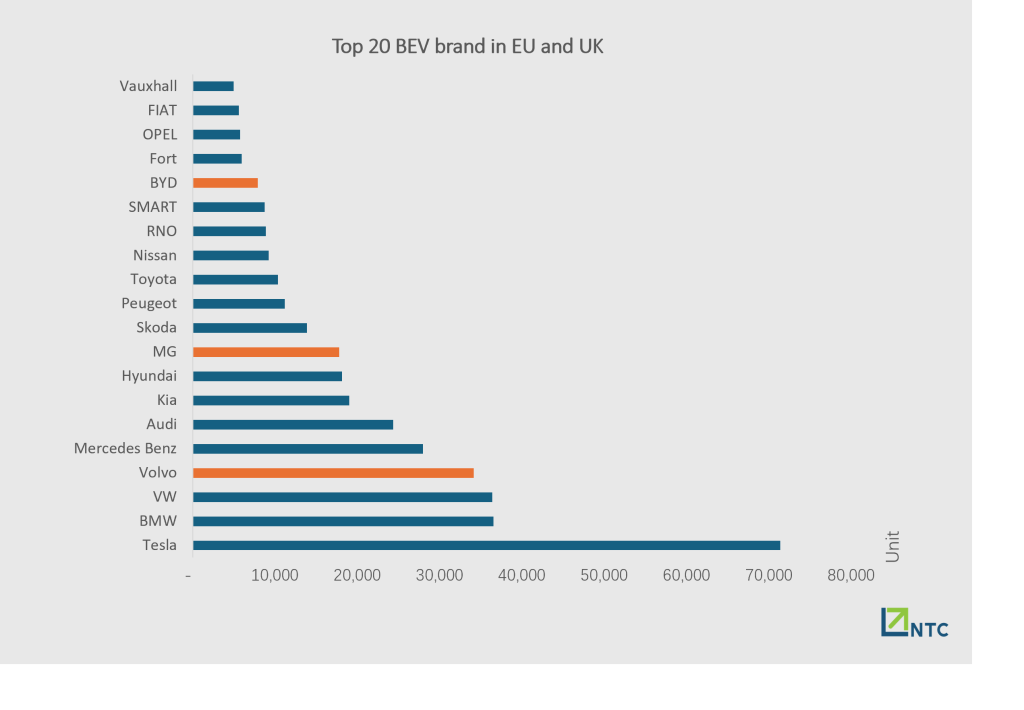

According to public data, as of April this year, Tesla’s sales volume continued to lead by a large margin. Although the announcement has stated that special tax requirements may be given to Tesla produced in China, the details have not been clearly disclosed. Tesla has announced that due to the impact of the EU’s tariffs, it is expected to increase the price of model 3 cars manufactured in China and sold in the EU from July 1. In the first four months of this year, the number of model 3 sold in Europe exceeded 17 thousands units. Meanwhile, the market share of the three Chinese auto brands is significantly behind other automakers.

Export of new energy vehicles in China:

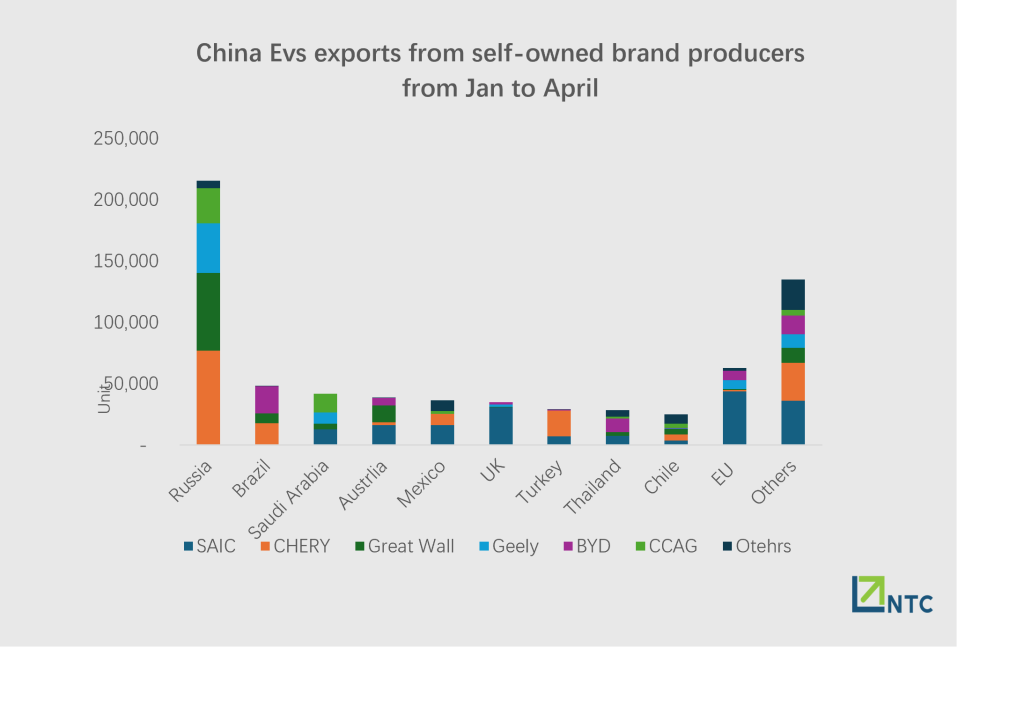

According to customs data and public data, as shown in the following table, SAIC Group is the main automaker exporting to the EU.

However, the number of EVs exported to Russia this year has begun to rebound significantly. As dominating carmakers almost complete their overseas industrial layout, the direction of automobile exports has been basically clarified. EU is not the direct destination of exports so far.

According to data released by the China Passenger Car Association, China’s passenger car production in May basically remained stable at two million units, and the monthly production of BEV finally exceeded 500,000 units, up 6% month-on-month and flat y/y. The production of PHEV continued to rise, breaking through the historical high to reach 378,000 units, up 15% m/m and 61% y/y. At the same time, the production of non-Evs passenger cars shrink further, down 6% m/m.

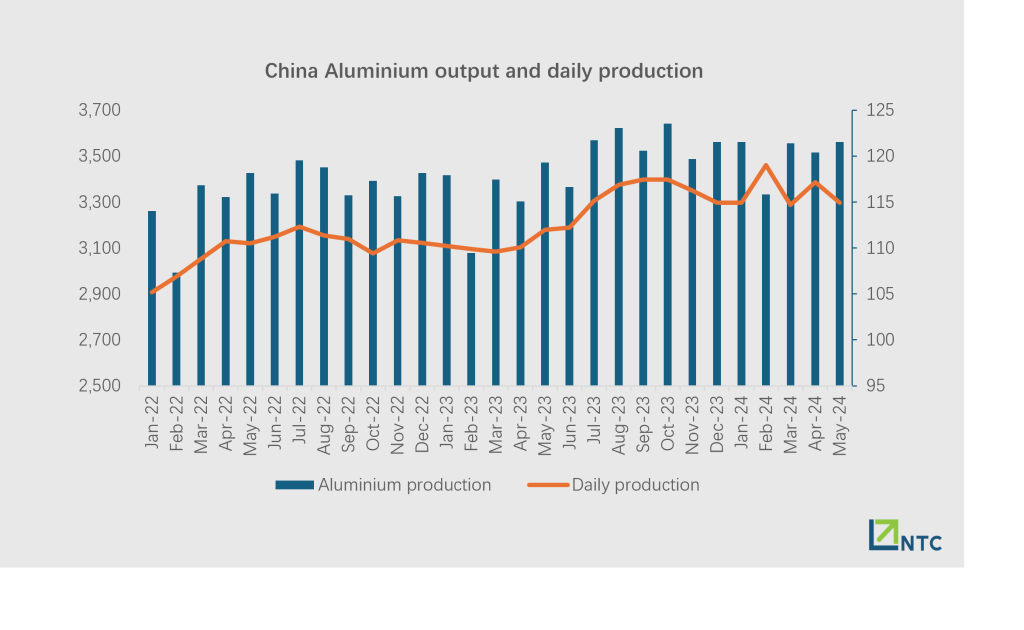

In theory, the amount of aluminum used in the automotive industry continues to rise, but at the same time, China’s aluminum output recovered steadily. In the end, the proportion of passenger car demand for electrolytic aluminum remained stable at 10% in May.

Reproduction without permission is prohibited